Labor costs are part of doing business. Paying workers makes up the largest part of most companies’ operating expenses. Obviously, your employees need to be paid, but if your labor costs aren’t tracked and managed, they can quickly inflate. With such a large percentage of your costs going to labor, this is one area that can drastically affect your profits.

When employers utilize modern methods to calculate and track labor costs, they are better equipped to scale their workforce to the workload. That means companies don’t pay for employees they don’t need and resist overworking the employees they have. And, going a step further by implementing mobile time tracking solutions, companies can make sure they’re only paying employees for actual time worked and eliminate unnecessary overtime.

What is Labor Cost?

As mentioned above, determining your labor costs is instrumental in keeping projects not only on budget but actually profitable. So, what is labor cost? Labor cost is the direct and indirect price that a company pays for labor. These costs comprise anything and everything related to employee wages, including but not limited to:

- Payroll Taxes

- Overtime

- Health Care Benefits

- PTO

- Insurance

- Bonuses

- Retirement Contributions

- Supplies

- Equipment

- Training

- Meals

Direct vs. Indirect Costs

Your construction business has two categories of labor costs: direct and indirect.

Direct costs are the hourly wages you pay employees who are directly involved in manufacturing a specific product or service. As long as the work performed is related to a specific task, it is a direct cost. Direct labor costs include paying these employees not only their regular working hours but also overtime hours, payroll taxes, unemployment tax, Medicare, employment insurance and so on, according to the Corporate Finance Institute.

Indirect costs of labor are money paid to employees that support a project but aren’t directly involved in its production. These are your workers who work “behind the scenes” to keep your businesses running efficiently but don’t directly manufacture a product or build an onsite project. Keep in mind these costs also include any overtime, taxes, insurance and so on.

Labor Cost Examples

To go a little deeper, here are some examples of a business’s labor costs.

Direct Labor Costs

Workers who add to direct labor costs include those who are directly involved in working on or completing a project. For construction companies, this includes laborers, heavy machinery users, electricians, masonry, fabricators, craftsmen, artisans and any other worker that directly contributes to completing a project.

For a construction company, direct labor costs include the hourly wages, benefits and payroll taxes of your laborers plus anyone who directly supported the project, like subcontractors. Direct labor would also include the costs for any employee out on short-term disability or worker’s compensation.

Indirect Labor Costs

Indirect labor comprises those employees who support the company but don’t directly work on a project. These roles include maintenance, accounting, managerial, office staff and HR. While all of these roles are essential to running your business, the employees aren’t performing physical work on your projects.

Examples of a construction company’s indirect costs are the hourly wages, plus benefits and payroll taxes, of your company’s office manager, janitorial staff and site foremen.

According to Indeed, labor costs can further be broken down into fixed and variable costs.

- Fixed: Fixed costs are usually contracted costs but sometimes includes essential costs that are predictable.

- Variable: Variable costs increase and decrease with variables like production demand and economic conditions.

Fixed Labor Costs

As fixed labor costs are predictable and shouldn’t change, they usually include salaried employees or employees that only work 40 hours per week, no more, no less. Unless a pay raise or bonus occurs, these costs remain relatively predictable. For example, your office staff may not be required to work overtime, thus their labor costs are fixed.

Variable Labor Costs

More than likely, your direct labor hourly employees contribute to your variable labor costs. Variable labor costs adjust to demand and economic conditions. For example, if a project requires employees to work overtime to make deadline or if rain keeps workers off site, then labor costs will change. According to Indeed, another variable labor cost could be attributed to contract workers who respond to things like equipment malfunctions and other emergency repair services that are critical for business functioning.

How to Calculate Labor Costs

Accurate labor cost calculation requires more than just examining your employees’ wages. It means calculating every amount that goes into employing your workers. For example, you may be paying a worker $18/hour but he or she may be costing you as much as 60% more than that.

Gross Wages

Start calculating labor costs by determining your gross wages paid. Your gross wages include both hourly and overtime earnings. For example, if an employee makes $25 an hour and works 1,920 hours in the fiscal year (with no overtime), their gross income equates to $48,000. Use our time clock conversion table to calculate minutes to decimals.

Field Labor Burden

The next step is to determine your field labor burden. Field labor burden is the additional amounts on an employee’s paycheck above their hourly wages such as taxes, worker’s compensation and vacation pay. Calculating field labor burden requires adding these extra expenses.

Note: field labor burden is only applicable when it pertains to all employees. If it’s a unique instance that only affects a singular employee, it should not be included in your field labor burden calculation.

Benefits

Benefits are another area that figure into your total labor costs. This is an important step as benefits contribute to a large chunk of your labor costs. According to the Bureau of Labor Statistics, the average cost of employee compensation for civilian workers is $38.20 per hour. Wages account for $26.17, while benefits make up the difference:$12.04 per hour, or more than 30%.

Standard benefits include:

- Health/medical, dental, vision, life, and disability

- Paid time off and vacation days

- Retirement plan assistance, such as matching 401(k) contributions

- Supplemental pay and bonuses

- Equipment and Supplies

For some industries, there also might be significant onboarding costs to get new employees ready to start work on day one. Your new employees also might require:

- Uniforms

- Protective gear

- Cell phones

- Computers

- Vehicles

- Tools

- Desks

- Chairs

Don’t forget to consider ongoing training costs for employees. For example, certain workers might require certifications and yearly training to retain licensing and run machines and other types of equipment.

Taxes

Lastly, taxes need to be factored into your total labor costs. The tax withholding list below covers the basic taxes most employers pay. However, there may be additional tax considerations that you’ll have to include.

Note: when calculating tax withholdings, be sure to do so with an accountant for an accurate calculation.

- Social Security – 6.2% (not to exceed $127,200 in total)

- Medicare – 1.45%

- Federal Unemployment Tax Act (FUTA) – 6.0% (of a maximum $6,000)

- State Unemployment Tax – This figure varies by state

Labor Cost Calculation

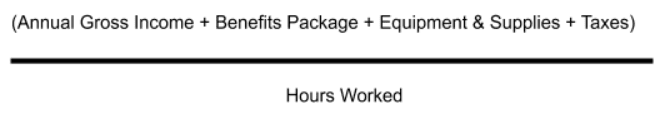

Once you’ve figured the above amounts, you need to add the figures together and divide by the total number of hours worked in a year to find the true cost of labor for your business. That formula would look something like this:

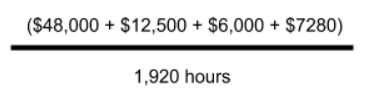

Here is an example:

- Annual gross income: $48,000

- Benefit package: $12,500

- Equipment and supplies: $6,000

- Taxes: $7,280

These numbers total $73,780. Using 1,920 as the number of hours worked in a year, the total labor cost for this example is: $38.48 per hour. Although you’re paying your employee $25 an hour, your true labor costs are actually 53.7% more.

How to Lower Labor Costs

The main reason for calculating your labor costs is to make sure your business is running as efficiently as possible. It also gives you an idea of where you can lower your labor costs. While lowering worker pay may be the easiest solution, it’s certainly not the most popular; your workers won’t stick around if you keep cutting their pay.

Here are some other options that might work better (and how HR can help).

Streamline Your Benefits Process

Benefits make up a huge portion of your total labor costs (30%) and healthcare is part of that. According to SHRM, large companies estimate that their total cost of health care, including premiums and out-of-pocket costs for employees and dependents, will rise to $15,375 per employee in 2020. It’s no wonder that lowering these costs is a top priority. Implementing a benefits solution allows HR to offer employees options based on different price levels, accessible by a cloud-based employee portal. The portal can include brochures to plan links, videos, guides and more so employees can thoroughly research a plan that works for them and their families.

Reduce Your Turnover

As mentioned above, training and fitting a new employee with soft and hard skills plus uniforms, tools and equipment is not only time consuming but also expensive. The longer you keep your employees, the lower your onboarding costs will be. Implementing a good retention strategy is paramount to reducing your turnover rates. Providing adequate compensation, great benefits, performance management, development opportunities and conducting stay interviews are all ways to retain your employees.

Hire the Right Employees

Reducing turnover is also accomplished by implementing a hiring strategy that attracts the right candidate. Post job descriptions that accurately describe the position so there are no surprises. State what is required to do the job, including any physical requirements. Use an ATS that automatically posts to job boards that reach your target audience and sets parameters so only qualified candidates can submit their resumes.

Cross-Train Employees

Development programs do more than just retain your employees, they give you an opportunity to fill any skills gaps at your company. When employees are trained in multiple positions, they can help make up time when another is out sick or on vacation, lowering your variable labor costs. And, if an employee does quit, companies won’t be left scrambling to finish a job only that person knew how to do.

Automate Your Time Tracking

Closely watching your rising labor costs is hard enough, but if done on paper, you could be setting yourself up to fail. A digital time tracking solution, like ExakTime’s proprietary employee time tracking app, helps reduce costs associated with data entry, clocking in and report creation. It also eliminates hour-rounding by employees, which can reduce the cost of payroll significantly.

Automated time tracking:

- Provides better, more accurate time tracking data. Companies that utilize time cards or spreadsheets don’t always know what parts of the process slow them down and which are open to error. A digital, cloud-based system not only saves time in the field but also reduces errors in data collection.

- Converts time tracking into payroll more efficiently. Not only does a time tracking app reduce calculation errors but it automatically syncs with many accounting programs. There are no uploading and/or downloading files so the process is simplified and exact.

- Tracks progress, trends and any other worker concerns. A time tracking app gives employers the ability to track worker clock-in, clock-out times, locations, cost codes and field notes so if there is a hiccup, the reason can quickly be found. It allows employers to see in real time what is going on in the field. For example, if a project’s labor costs are skyrocketing, a report can quickly tell you who is working and how many hours.

Use our payroll calculator to see what paper time cards are costing you.

ExakTime’s time and attendance tracking puts a stop to losing money on paper time cards. You also get clear visibility on the field in more ways than you imagined—helping your business lower labor costs, ease compliance and do more.

Labor Cost FAQs

What is labor cost?

Labor cost is the direct and indirect price that a company pays for labor. These costs include anything and everything related to employee wages.

What are direct labor costs?

Direct costs are the hourly wages you pay employees who are directly involved in manufacturing a specific product or service.

What are indirect labor costs?

Indirect costs of labor are money paid to employees that support a project but aren’t directly involved in its production.

What are fixed labor costs?

Fixed costs are usually contracted costs but sometimes includes essential costs that are predictable.

What are variable labor costs?

Variable costs increase and decrease with variables like production demand and economic conditions.

How do you calculate labor costs?

(Annual Gross Income + Benefits Package + Equipment & Supplies + Taxes) / Hours Worked